The Death of 60/40

Author: Dean Andersen, Kernel Wealth

For decades, Modern Portfolio Theory has shaped the way investors, financial advisers and institutions around the world have invested. Developed in 1952 by Nobel prize-winning economist Harry Markowitz, Modern Portfolio Theory suggests that “investors can construct portfolios to maximize expected returns based on a given level of market risk.”

This led to the birth of the 60/40 portfolio. While bonds aren’t generally viewed as return enhancers, they can act as volatility dampeners. Typically, in a recession central banks around the world will use interest rate reductions to stimulate growth. If you, as an investor, have bonds as well as shares in your portfolio they can counterbalance each other during times like these, because often when interest rates fall the value of bonds rise.

Over the decades, by combining these two asset classes in the 60/40 split, investors were able to receive 87% of the return they would have received if just investing in shares, but with 45% lower volatility. This lower volatility meant over the past decade, the largest monthly decline of a traditional 60/40 portfolio was just 35% of the largest decline in the S&P 500.

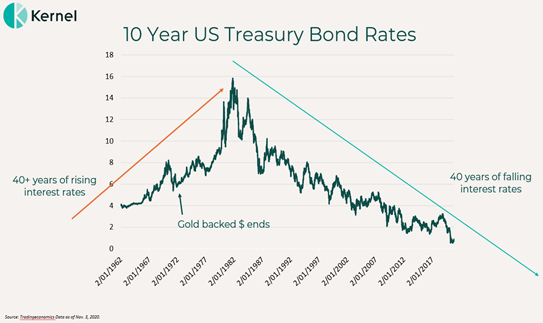

However, there has been one consistent factor that has benefited the 60/40 portfolio, that is the 40-year decline in interest rates. Declining interest rates result in the value of bonds increasing, which meant that the 40% in bonds was also boosting the total return of the portfolio. In fact, the Barclays Aggregate index has returned 7.75% per annum, comfortably outpacing inflation, with strong real returns.

What happens to the 60/40 portfolio when the effective interest rate after inflation is now 0%? The success of the 60/40 portfolio may have come to an end, with the basic math of the situation being unforgiving.

With the return on interest bearing investments such as term deposits and bonds now delivering a real negative return, the once expected benefits of allocating 40% of a portfolio to bonds is now eliminated.

In this new world, the behaviour of bonds, i.e. their tendency to raise in value when shares decline, will also be questioned. Therefore, with negative real returns, bonds have become an expensive insurance against share market declines, particularly if they no longer maintain their diversifying properties.

The challenge for fixed income investors was highlighted by a familiar oracular voice from Omaha, reminding everyone of just how extreme the bond market had become. Warren Buffett, still CEO of Berkshire Hathaway Inc. at the age of 90, published in his annual letter to investors:

“Bonds are not the place to be these days. Can you believe that the income recently available from a 10-year U.S. Treasury bond – the yield was 0.93% at yearend – had fallen 94% fPublishedrom the 15.8% yield available in September 1981? In certain large and important countries, such as Germany and Japan, investors earn a negative return on trillions of dollars of sovereign debt. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.”

What about inflation?

Inflation also creates a risk for bond holders. If inflation rises, so too will interest rates, causing the value of bonds to fall.

With the largest level of non-wartime fiscal stimulus, nearly ten times as large as in the GFC, the G20 group of nations has provided fiscal stimulus to the end of June 2020 equivalent to 13.6% of GDP compared to 1.4% of GDP in March of 2009.

Further fuel to support the economic recovery has been provided by central banks cutting interest rates and embarking on large-scale asset purchases. Increasingly, these same central banks are signalling a tolerance for higher inflation should it materialise, with the US Federal Reserve Chairman shifting the inflation target from 2% to an ‘average’ of 2%.

Within the past month, inflation expectations have risen given global supply constraints. The status quo of persistent low inflation may be at a credible risk for the first time in decades.

And while uncertainty remains, particularly as to whether any inflation will be persistent, it highlights the increasing risk to bond holders of the greater probability of interest rate rises in the mid-term, rather than ongoing cuts into negative interest rate territory.

Where does this leave investors?

Today, as the bond component of a traditional balanced portfolio provides little income and limited capacity to appreciate at times of equity market declines, fixed income has lost much of its appeal. This gives savers and investors the uncomfortable prospect of having to take on more equity market exposure to generate adequate returns while trying to limit losses.

This may be hard to hear for many Kiwi investors given our significant investment in term deposits ($170b), and the fact over half of the $62b KiwiSaver sector is held in default (soon to shift from conservative funds to balanced), conservative and balanced portfolios.

What are the alternatives? Thankfully there are options, with today’s investor having access to a far greater range of products than ever before. Real assets, such as infrastructure, can provide protection with inflation linked revenue sources, higher yields, and potential for strong growth through fiscal stimulus packages. Equally, advisers can consider more defensive equity strategies, typically higher dividend exposures. Both of these strategies have historically had low correlation to broader equities and bonds, providing diversification benefits.

In combination with one another, using various investment strategies and themes, advisers can increase the equity weighting of their 60/40 portfolio (to 80/20 for example) yet achieve a similar smoothing effect that you would have seen by traditionally investing in bonds. The total risk profile of the portfolio remains relatively unchanged, while investors have an appropriate mix of assets to ensure they meet their return objectives.

We are more than happy to share our research and thoughts on this topic, but it is something that all investors will need to consider in this new environment.

Re-published with permission from the author