It's never too late (or early) to start investing

When we’re young, it can be difficult to understand and trust in the investment process.

These days, everything is more transparent and accessible, but getting started can still be difficult. Foregoing a part of todays “enjoyment”, for the benefit of tomorrow is still hard to do. For would be investors, popular brands have a greater draw - enticing you to engage. Without question, dynamic and sexy businesses create excitement, and can then hold the attention of young and old investors alike.

Let's take a look at some big name brands, that have been around a long time...

- In 1980, had you invested US$1,000 into Walt Disney, today (41 years later) that US$1,000 would be worth US$154,000 (a return of around 13.5%pa).

- That same year, had you invested US$1,000 in Nike, it would be worth US$904,000 today (18.55%pa)

- Or Apple - US$1,000 invested in 1980, is now worth US$10,066,000 (25.92%pa)!

- Netflix was listed in 2002, US$1,000 invested then is worth US$451,000 today (in just 19 years, that’s 37.94%pa return).

Big brands, massive gains. Perfect hindsight. So easy!!!

Or was it? Investing isn’t always plain sailing. One of the most important factors for investors to understand is risk. Risk is the possibility that an investment “can” lose some (or all) of its value, while reward is all about having more! Diversification is a key factor to throw into this mix, as it tends to lower the return, but it may ultimately amplify the reward - because it tends to reduce the overall risk.

New “platforms” like Hatch, Sharesies, Robinhood and InvestNow make everything available online. Investing has never been easier and while markets are running higher, it feels like you can’t lose. As a professional investor, it’s definitely getting easier for the average person to access share markets, but the game itself hasn’t really changed all that much. With more players, are we seeing more extremes?

Financial Planning is multi-dimensional and just as concerned with mitigating risk as maximising return. In this mad world, the “internet of everything” focuses on the short-term. Life’s not actually like that - it can be for a select few, but for most of us, a measured and steady approach will be more reliable.

Investment values will rise and fall. Whatever the outcome, the experience of watching both value gains and losses is priceless. Seldom does a company fail completely, it’s share price falling to zero in front of your eyes; but over time, society can move in such a way that there is no longer a need for some services or products to be produced. Things change - constantly! Only time remains the same (yet feels, constantly faster).

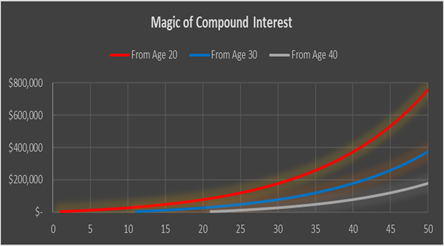

Have you seen the magic of compound interest? What if at age 20 you took the cost of a daily coffee (around $5p.d / $35p.w) and for the next 50 years you invested it for an average net return of say 7%p.a. That simple act turns a cuppa per day into $760,000! If that daily sacrifice didn’t start until you were 30, then the value by age 70 reduces to $373,000. Only starting at age 40, and it compounds to $176,000.

The longer we delay the start, the more we must save. Equally, it’s never too late to start!

We encourage as many starting deposits as possible, but be careful about the source of “good advice” (social media and the internet can be helpful, but can often miss the truth).

Set your goals, then set “different strategies” for the short, medium & longer term targets.

Tony Munro | CFPCM, Post Grad Dip. Bus.Studies (PFP), FSP5501 Director | Fortitude Financial

The views and opinions expressed in this article are intended to be of a general nature and do not constitute personalised advice for an individual client. A disclosure statement is available on request and free of charge.