Imperfect Hindsight

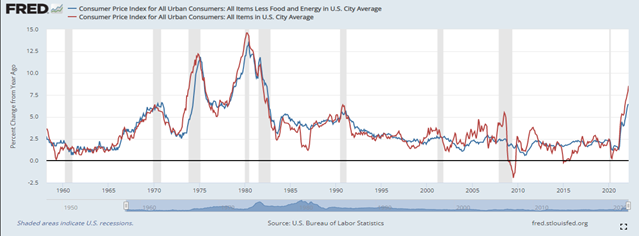

There's been numerous headlines about inflation, and of short-term interest rates pushing higher than long-term rates (an inverted yield curve). Some now wonder if this indicator is a precursor to recession? Whilst a recession is not inevitable, economic growth is likely to slow materially in coming months, as consumers adjust to the rapidly rising costs of food, heat and shelter (life’s essentials). Vladimir Putin’s decision to wage war immediately after the Winter Olympic Games was perhaps an error in the renowned chess players opening move. Europe now heads into Summer and so, the ensuing strangle hold on energy supply will be less bad for Europe than had it would have been Winter. Starving Russian fuel is both an escalation of uncertainty but also, an opportunity for new supply networks to emerge.

With interest rates rising to combat inflation, the consensus is that the US economy is sufficiently robust to absorb early rises, but with the uncertainty of the war in Ukraine, and China in stages of Covid lockdown, it all makes for shortages and bottlenecks persisting. Price uncertainty may last for many more months.

Share markets have been falling since the start of the year, and more dramatically of late. In times of extreme uncertainty, it’s normal to second guess oneself and fear that; “This time, it’s different”. “This time, it could be the "big one"”. With 65 years evidenced below, we reckon this time it’s no different. Throughout history, no matter how sure we may have been that the sky was falling, it didn’t. Yes, there are times when losses can be realised if we sell at the wrong time. The counter to that might be to recognise the massive gains that can be had if buying at the right time (or - the smart money simply holds on).

Central Bankers are reacting as they should, pushing interest rates higher to curb inflations advance. This creates much needed headroom for when the next crisis arrives, so that interest rates can then decline (and that will be when we need them lower, as to avoid a deep recession). So, for now with low unemployment and a global economy chaffing to leave the pandemic behind, there are economic tail winds building, which will add to inflationary concerns.

The trick for investors is to weather the storm of negative sentiment. We know not to measure the value of long-term investments in the short-term, because it tempts us to deviate from our course and to take on more risk (trying to time the markets simply invites more mistakes). As it is, we already invest in great businesses, and we know that good business always takes time. If we had no intention of selling those companies in the next year or two, why would we now decide to sell, because others suddenly find themselves over exposed to short-term volatility? Their issues are not ours and we’ve already insulated our short-term financial needs by having an appropriate asset allocation prior to today’s volatility and or, we have the resources to see us through today’s uncertainty.

Tony Munro | CFPCM, Post Grad Dip. Bus.Studies (PFP)

The views and opinions expressed in this article are intended to be of a general nature and do not constitute personalised advice for an individual client.